If you live in Texas, then you might be wondering how much is windstorm insurance. You might not know that the TWIA is the organization that provides windstorm insurance for residents of Texas. The Texas Wind and Hail Insurance Association (TWIA) provides windstorm insurance and the average residential policy costs $1,500 a year. If you’d like to compare rates and coverage, you can look to private companies that provide windstorm insurance. These companies are more selective and can provide you with lower rates than the TWIA.

TWIA provides wind and hail insurance to Texas residents

TWIA provides wind and hail insurance to residents of Texas. As the insurer of last resort for coastal counties, TWIA covers many rejected Texas homeowners. As an insurer of last resort, TWIA offers competitive rates and a wide range of policies. The insurance can be purchased through an insurance agent, but the requirements are rigorous. If your home does not meet the standards for windstorm certification, you may be turned down.

A typical home insurance policy in Texas may cover damage from wind, but not hail. Coastal Texas homes may not have this coverage. In that case, you’ll need to purchase a separate windstorm insurance policy. You’ll also need coverage for damaged property and contents. TWIA policies include a deductible of $15,000 and can provide coverage for personal possessions, and temporary living expenses. TWIA policies also cover the increased cost of reconstruction, which kicks in if the cost exceeds the policy’s limit.

Rates are determined by a replacement cost policy

A typical windstorm insurance policy includes five different types of coverage, each with a limit of liability, which is the maximum amount an insurer will pay out if you file a claim. Your dwelling coverage limit should be equal to the amount it would cost to rebuild your home from the ground up. Other structures coverage limits are generally 30 percent of the dwelling coverage limit. Listed below are the five types of coverage and their limits.

Premiums are determined by factors such as deductibles

A large part of premiums for windstorm insurance is the deductible, which is the amount that the policyholder pays before the insurance company pays any damages. The higher the deductible, the lower the premium, but it also means that the policyholder will have to pay more out of pocket if a loss occurs. Deductibles vary across policies, depending on the peril covered. Premiums can also differ if a policyholder elects to customize their policy with endorsements. Additionally, windstorm insurance policies may not cover older homes with outdated wiring.

Deductibles vary by state. Hurricanes usually carry a ten percent deductible, and in some states, a hurricane percentage deductible may be a large portion of the policy. In addition, a third deductible applies to earthquakes. These deductibles can differ wildly from state to state, so it’s important to check with your agent for specific requirements. In addition to deductibles, windstorm insurance also has a dwelling coverage limit, which is typically listed under the homeowner’s policy.

Coverage provided by private companies

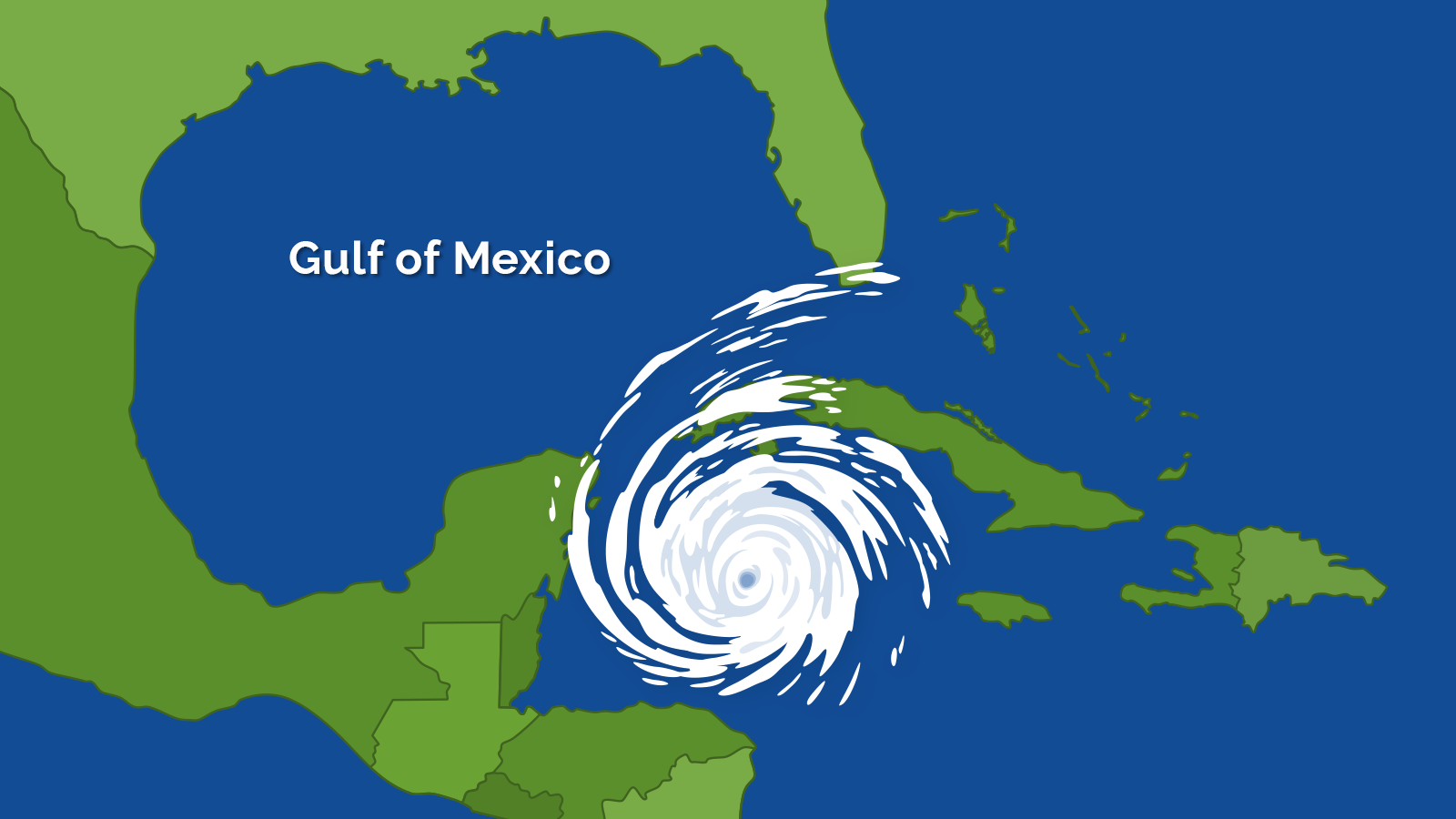

If you live in coastal Texas, you’ve probably heard that storms can be devastating. In Texas, TWIA provides wind coverage to homeowners, but it doesn’t cover storm surge, which is often a major determining factor in whether or not you’re at risk of losing your home. If you live in Texas’ coastal counties, you should consider purchasing wind coverage from a private company.

Although windstorms are rare in Texas, many of these storms are still devastating. While the state’s NFIP program (Texas FAIR Plan Association) offers windstorm insurance coverage, it’s usually only limited. You’ll be required to have a TWIA policy if you’re a member of the NFIP, but the private market can offer more comprehensive policies.